CENTENARY BANK FINANCIAL REVIEW

By Sam Kalimba

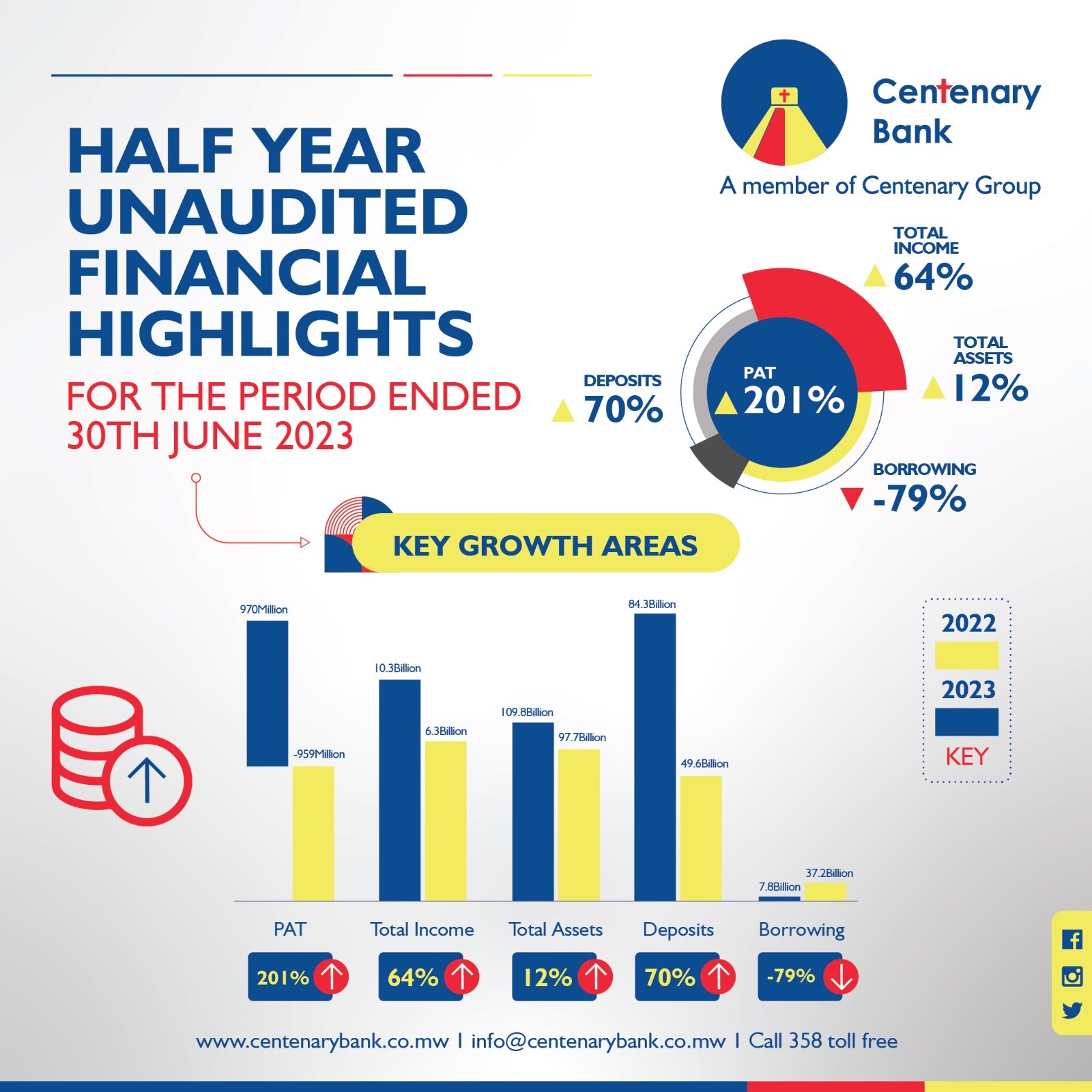

The Board of the Centenary Bank has presented a summarised, unaudited financial results for the six months ended 30th June 2023.

In economic highlights, the results indicate that headline inflation closed at 27.30% in June 2023 up from 25.4% in December 2022 and 23.4% in June 2022. it says that the increase was predominantly on account of currency depreciation and rising food prices.

“The Kwacha went through a mini depreciation mid-June 2023 losing around 3% of value. There is continued pressure on the kwacha as the country works on fixing the supply side of the currencies from major trading partners. The reference rate closed at 21% up from 17.3% in December 2022 and 13.8% in June 2022,” the results state.

The report asserts that the Group has achieved a remarkable turnaround from the adverse performance that was prevalent in the past two years. It shows that all key performance areas are showing signs of recovery and are pointing in the right direction.

“The group is now well-capitalised following a change in shareholding and capital injection at the beginning of the year. We have attained business volume growth and reduced the cost of doing business despite increasing economic pressures. Overall profitability for the Group stood at MK970 million at the close of June 2023 compared to a loss after tax of MK959 million up to June 2022, which represents a 201% increase in profitability,” reads the report.

The report further suggests that the Group earned MK5.3 billion in net interest income compared to the prior year’s net interest income of MK3.3billion representing 59% income growth due to a reduction in the cost of funding. It says the Total non-interest revenue increased by 59% to MK5.0 billion from MK2.9 billion earned in the prior-year period due to increased transactional volumes.

“We achieved 64% growth in total income to MK10.3 billion from MK6.3 billion due to an increase in transaction volumes and a reduction in the cost of funds. Impairment charges on loans and advances to customers rose by 111% to MK431 million from MK204 million due to various economic challenges faced by the business and the impact of Cyclone Freddy on our customers,” it reads.

The report states that operating costs rose by 14% to MK8.4 billion from MK7.4 billion in the prior year due to inflationary pressures. We focused strongly on cost containment to ensure below inflation cost growth. It says that total assets for the Group grew by 12% to close at MK109.8 billion in 2023 from MK97.7 billion following increased funding mobilisation and business volume growth strategies. We have repositioned our balance sheet through the repayment of borrowed funds and replacing it with deposit funding. In this regard, we have reduced our funding from borrowings by 79%, from MK37.2 billion to close at MK7.8 billion in June 2023.

It portrays that the bank’s funding through depositors has since grown by 70%, up to MK84.3 billion from MK49.6 billion in June 2022.

OUTLOOK FOR 2023

The results report puts that the Group expects macroeconomic pressures to persist in the second half of 2023, with sustained pressure on the kwacha and rising inflation.

“We expect the economic pressures, including the aftermath of Cyclone Freddy, to affect various businesses and customers’ disposable incomes and ability to meet their contractual obligations. However, we are optimistic about continuing with the growth trajectory as we continue to implement the various business growth strategies we have embarked on since the start of the year.

We will continue to focus on improving customer satisfaction and efficiencies, upgrading our systems, and driving the digitalization agenda to grow the business and enhance customer experience.

We will also continue to focus on cost rationalization, prudent management of risk and liquidity, and diversification of balance sheet funding while maintaining a healthy capital position,” it says.

The report was duly signed by the Board Chairman Dr. Francis Perekamoyo and other three officials.